Insurtech is the latest phenomenon that is revolutionising insurance across the spectrum. The insurance industry is innovating with the use of technology with an aim towards making products, services and solutions more affordable, personalised and quicker for customers.

Here are some of the digital technology offerings that are playing a major role in this space:

AI enables more accurate and improved pricing and assessments of risks. It helps insurance companies manage risks better while lowering costs simultaneously. It also ensures that customers get more personalised and cost-effective insurance offerings.

2. IoT- The Internet of Things is another aspect which enables cost reduction and personalisation alike. It also boosts customer experiences greatly. The insurance industry is leveraging IoT devices for collecting information on consumer behaviour and environments, including home security, driving habits, health, and so on.

This is facilitating accurate assessments of risks and pricing, while helping develop new products tailored to customer needs. For example, IoT devices may be used to develop insurance products where customers are charged on actual driving distance and usage.

3. Blockchain– This digital technology functions through distributed ledgers, enabling transparent and secure transactions without centralised intermediaries. It is being used in insurtech for streamlining the processing of claims and lowering frauds along with enhancing overall data security too.

4. Mobile Apps- Insurtech also functions through new-age mobile apps for boosting customer experience and making claims processing simpler. Customers are getting more personalised recommendations and higher control over their policies.

Mobile apps are also being used for tracking the status of claims, managing policy data, and getting personalised advice on products based on their behaviour and specific requirements.

5. Telematics- It is already being used for gathering data on customer driving behaviour and performance, enabling more accurate assessments of risks along with better pricing strategies. Products are thus tailored to meet the needs of customers in a more personalised manner.

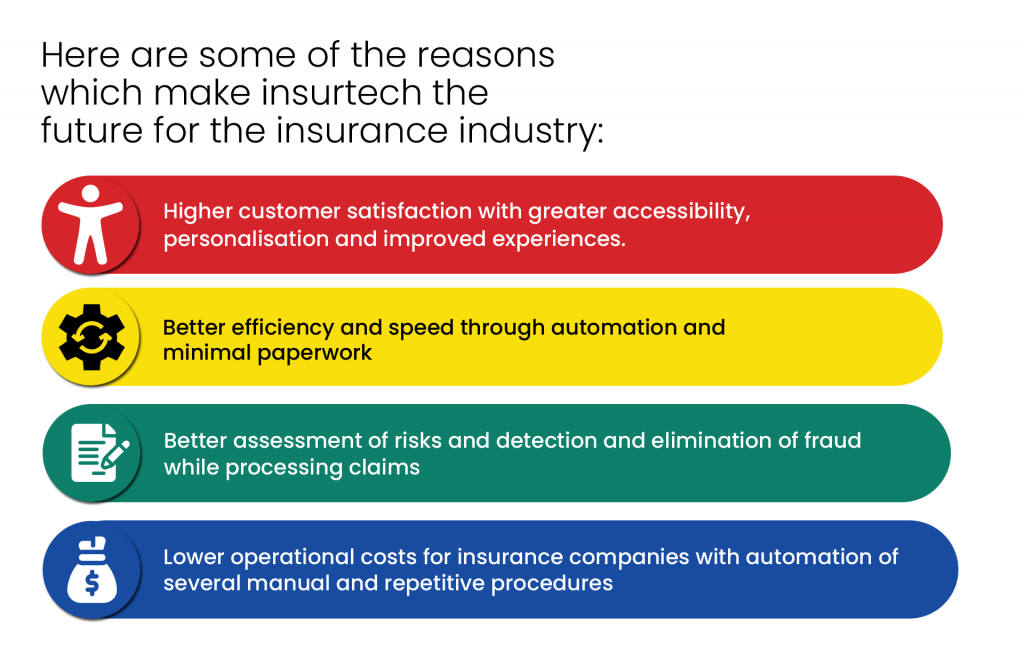

These are some of the chief reasons behind the rising popularity of insurtech solutions throughout the mainstream insurance sector.

1. Can Insurtech solutions replace traditional insurance providers?

Insurtech solutions can be replacements for conventional insurance offerings. However, they will not replace traditional providers completely. Rather, these companies will work closely with insurtech players to come up with better products and services for their customers.

2. Are Insurtech solutions regulated?

The insurance industry is one of the highest-regulated sectors in the world. Insurtech is also similarly regulated since it is used by insurance companies for carrying out many of their functions.

3. How does Insurtech impact the insurance industry?

Insurtech positively impacts the insurance industry by helping it reduce costs, automating manual and repetitive tasks, personalising customer experiences, scaling up overall efficiency, and making products/services more affordable for customers. Customers get more control over their journey with the insurance company and wait times are reduced considerably as well.

4. How can Insurtech solutions improve claims processing?

Insurtech solutions can automate claims processing, thereby saving time and money for the company. They can gather data and verify the same minutely in quick time, while also eliminating frauds alongside. This leads to more accurate processing of claims without any risks of losses/fraud.