Why are loan origination systems gaining ground globally?

Many lenders and financial institutions are of the opinion that loan origination system software tools backed by automation and other technologies are the best ways to enhance and streamline the overall lending process.

With a rapid leap towards digitization, conventional banking systems are finding it tougher to consolidate and grow their market presence.

With more consumers adopting fintech and other digital platforms for loans and other transactions, financial institutions are finding it favourable to invest in loan origination systems for future progress.

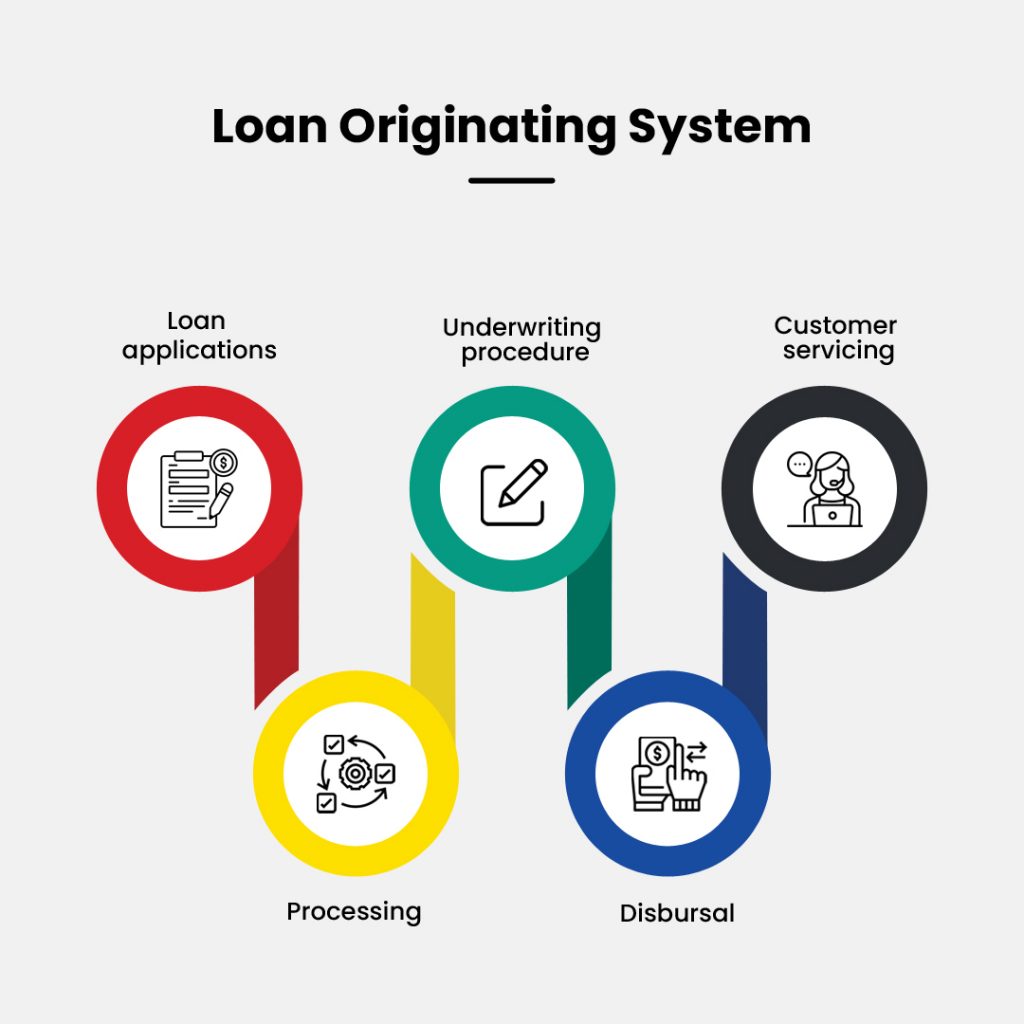

Digital open source loan origination systems can take care of the whole process of lending, right from the initial process of origination to the final disbursement. Institutions can tap such systems for enabling smoother onboarding of customers upon receiving their loan requests.

This system will take care of several aspects of the whole lifecycle, including application, credit checks, pricing of loans, digital KYC systems, and the final disbursal.

The basic loan origination system workflow helps immensely with regard to ensuring agile and smoother loan processes, while covering various kinds of loans, including retail, SBA, SME, commercial, and other types.

With the origination process well established, some of the biggest advantages include lower turnaround times for processing, greater data accuracy, real-time generation of reports, higher satisfaction of customers, greater monitoring and tracking mechanisms, and improved compliance and quality alongside.

An online loan origination system will take several aspects into account, including the following:

There are several loan origination system requirements that should be kept in mind. These include the following:

The origination system can help in automating end-to-end processes of lending, while centrally organizing workflows that cover everything from managing leads to the final disbursal and customer servicing.

The system should fuse various functions which are a part of the loan process under a single platform. This will lower manual and operational issues, while ensuring that customers get a more standardized and high-quality experience at the same time.

The system should garner all necessary details digitally, while helping with easier archiving, tracking, retrieval, control, and traceability. The origination system will also lower manual errors and overall cycle timelines.

The origination system should easily integrate with the legacy and core banking systems of financial institutions, while automating various aspects including validating credit scores, managing leads, and checking blacklists.

Deviation and credit policies usually begin with specific guidelines and are standardized through similar scenarios occurring repeatedly, which leads to higher wastage of time for workers in various sectors. The right automation system can take care of business cases which are repetitive and also enable empowerment of personnel to emphasize more on transactions with higher values.

The loan origination system should enable a financial institution to manage compliance better, while arranging procedures seamlessly for easier traceability and visibility.

The loan origination system should be flexible enough for ensuring that tailored solutions work in contextual scenarios, instead of being imposed and standardized solutions. This will lower the time of implementation while enabling swifter time-to-market for institutions as well.

A good loan origination system can enable quicker loan processing and better customer experiences in sync with digitization of the entire banking and financial services sector.

This is why loan origination systems are becoming the preferred mechanism for several financial institutions.