Did you know over 50 million people worldwide are unbanked? This paves the way for electronic money or e-money, as a smartphone is the only requirement. E-money is the electronic monetary value store operable through technical devices to make payments. But doubts regarding its safety are in the air.

Why E-money?

Per this research, banks worldwide are integrating e-money to offer an efficient currency transaction facility to their customers. It aids the execution of global money transactions at the speed of thought. It also improves recordkeeping without any physical burden.

Why Make E-money Safer And How?

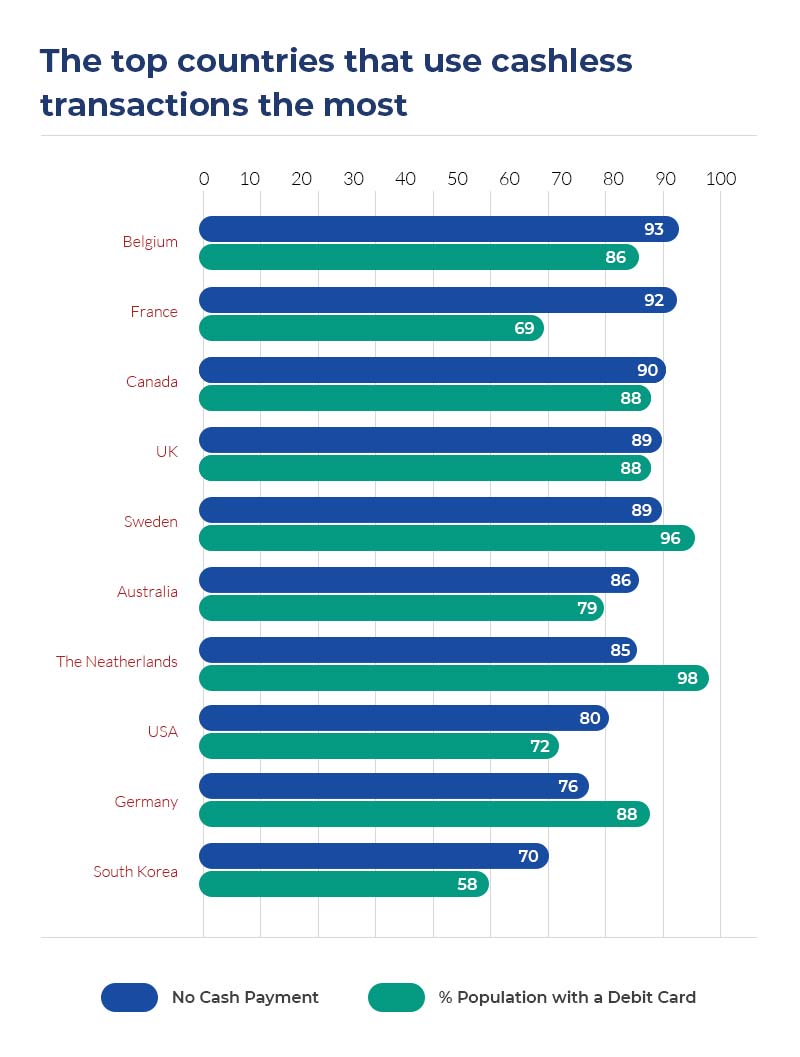

Electronic money allows cashless transactions and is considered transparent and safe in general, drawing millions of users who depend on e-money to make up for their lack of formal bank accounts.

But loopholes are emerging as it continues to evolve and become integral to our daily lives. To prevent the electronic payments industry from becoming unsafe and unreliable, stricter enforcement is essential.

E-money functions on a regulated framework, unlike other private digital money gateways. This fails to guarantee the desired protection and security paradigms required by today’s consumers.

A robust and comprehensive framework having restrictive rules is the best possible remedy. Establishing operational systems for risk management and governance on the framework would protect consumer data, handle disclosure fees, and deal with customer complaints.

To protect customers’ funds, safeguarding and segregating approaches are mandatory for all issuers to implement. Maintaining a secure liquid fund pool equivalent to customers’ balances is a critical safeguard. This would ensure monetary recovery in the event of bankruptcy and fund misuse.

However, the lack of clear bankruptcy regulations for e-money issuers might cause money segregation to backfire. Customers would also be deprived of quick access if issuers fail to solve the problems as the fund stays apart. The combined solution is continuity assurance of critical payment services through a recommended set of rules and policies.

There is a continuous push to expand the e-money presence globally. FCA data presented companies to process more than £500bn of transactions for 12 months till June 2021. Depending on the size and business model of the e-money system, supervisors and regulators must set up user safeguards and increase prudential control.

The countries having systemic issuers need to maintain payment service continuity and preserve customers’ funds, simultaneously. This requires extra efforts to assure protection and make it work effectively. Customer accessibility issues can be resolved by using services that are easily changeable and repairable.