Data ownership in Indian banking is a prickly aspect that most BFS players are slowly coming to terms with.

When it comes to data security and data privacy, banks and financial institutions are learning to depend on the Blockchain in recent times. They are integrating this advanced technology into their Cybersecurity initiatives on a bigger scale.

But does Blockchain revolutionise data ownership and its security in Indian banking? Here are a few aspects that should be closely examined in this regard.

Data privacy or security is one of the biggest concerns for the global financial industry in recent times. Institutions now have to maintain stringent data security standards in order to safeguard their customers and businesses.

Here are some points that highlight the importance of data security for the financial industry:

Technology is continually in a state of flux. With more updates and integrations, there are increasingly evolving cyber threats to deal with.

The importance of data privacy and security is unparalleled today for the financial industry. Hence, widespread reliance on Blockchain technology, subject to governing protocols, may help them maintain stringent data ownership and security controls.

This will automatically enhance brand reputation and safeguard consumers from data thefts.

1.What are the advantages of decentralisation in securing data ownership in Indian banking?

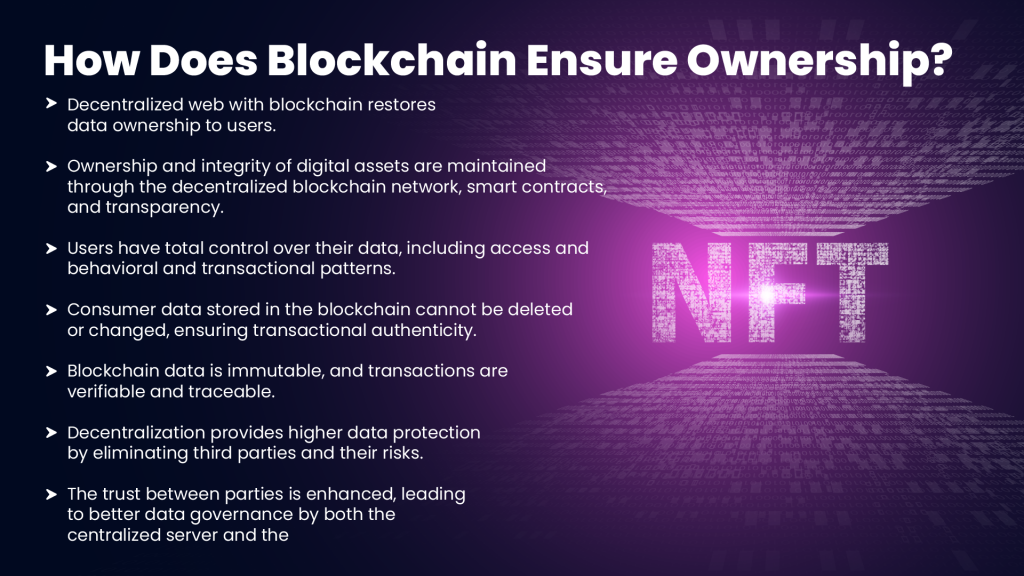

Decentralisation does away with third parties, thereby eliminating risks of data loss or leaks. At the same time, users have more control over their data once they record the same on the Blockchain. They can control access to the same, while the data cannot be changed or modified.

2. Is blockchain the future of data ownership and monetisation?

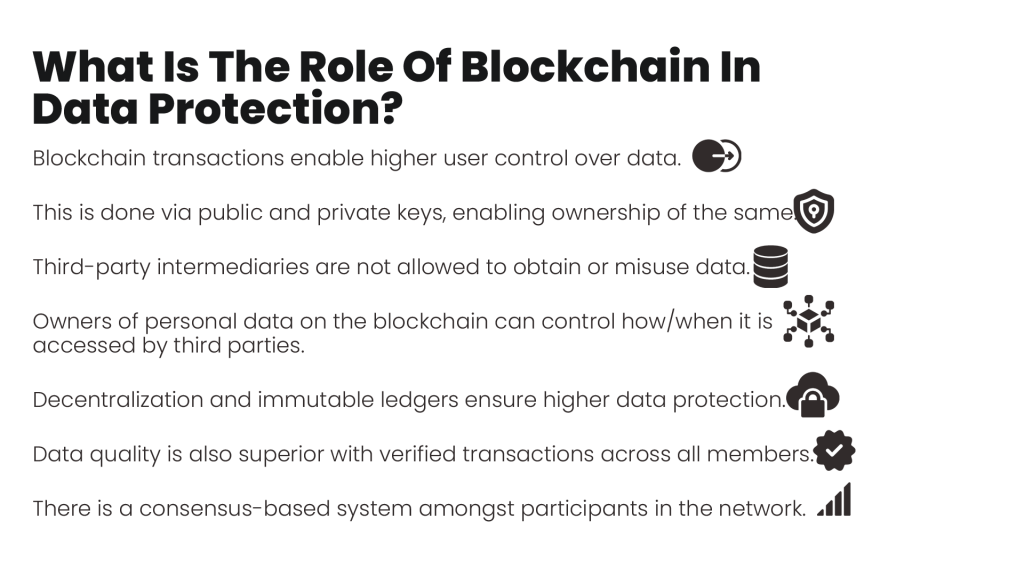

Blockchain seems to be the future of data monetisation and ownership with verified and immutable transactions along with higher user control over data.

3.What are the advantages of decentralisation in securing data ownership in Indian banking?

Decentralisation means that third parties are not required for transactions. Hence, there are no third party risks or data misuse concerns for banks. At the same time, transactions are verified and authentic.

Data ownership is higher for users, with full access control and blockchain data cannot be changed or modified in any manner.

4.What are the potential risks and challenges associated with data ownership in the Indian banking industry?

Data ownership risks and challenges for the Indian banking industry include leaks and misuse of data by third parties, tampering of data by cyber-criminals, continual threats of malware, hacking and other attacks and so on.