The impact of social media on the BFS (banking and financial services) industry cannot be underestimated today. Social media adoption has earlier been slower in this segment due to several concerns relating to compliance, perception, and industry regulations along with anxieties regarding reputation. The industry was hitherto regarded as conservative. However, banking and financial services entities are venturing into social media for tapping its sheer potential in recent years.

Many retail BFS players are now developing their digital presence via mobile banking and other digital applications, in addition to building omnichannel touch points for customers through social media platforms. Social media analytics is redefining customer engagement and driving marketing strategies for BFS firms. With AI and machine learning for the analysis of innumerable data points garnered via social media platforms and combining the same with existing customer database intelligence and reviews, brands are steadily tapping data-driven insights which are shaping their future products.

Digital marketing and target marketing campaigns executed by banking and financial services players are now increasingly being shaped by social media analytics. Consumers are spending more time on social media platforms and they are steadily becoming ideal avenues for raising awareness, disseminating consumer education, and enabling potent customer engagement. Reports indicate how leading banks in the U.S. scaled up their overall digital followings by a minimum of 30% (quarterly basis) last year, across social media platforms like Twitter, Instagram, and YouTube.

From tapping customer metrics to doing research on prospects in the enterprise space, forecasting consumer trends, and backing data-based innovation, social media analytics is transforming the entire rules of marketing and outreach for BFS firms.

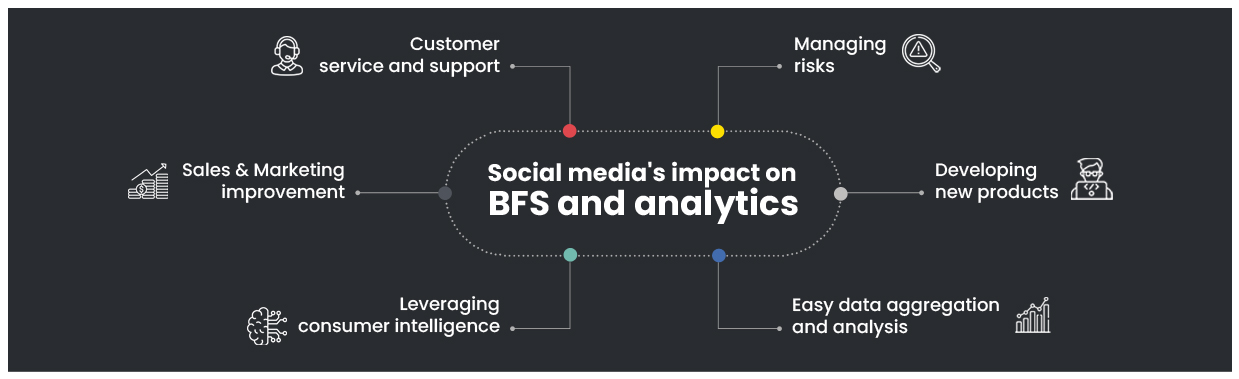

Social media analytics is immensely helpful for banking and financial services institutions in the following ways:

Banks and financial institutions have multiple advantages to harness through social media analytics. Financial firms can gain multiple advantages through integrating these tools into their business blueprints. They can also become more customer-focused entities that can reach out to their audience base with specifically targeted products and services.

At the same time, they can also analyze or revamp strategies for businesses on the basis of customer preferences and feedback. They may also boost overall customer experiences, while tackling and tracking risks in a more pro-active manner. It is time that financial institutions should incorporate social media-based strategies into their strategies in the near future.

What social media platforms are most relevant to the BFS industry, and how can they be leveraged for marketing and customer engagement?

Social media platforms like Twitter, Facebook, Instagram, and YouTube are highly relevant for the banking and financial services industry. They can be tapped with social media analytics in order to generate consumer feedback, insights, and preferences, which can help drive marketing and customer engagement strategies.

What regulatory considerations should BFS companies be aware of when using social media analytics for marketing and customer engagement?

There are several global regulations instituted throughout several countries and regions. These include the fair lending act or equivalent regulations along with other ethical considerations as outlined by the authorities.

What are some emerging trends and technologies related to social media analytics that BFS companies should be aware of?

AI-based content, integration of social media metrics into KPIs of companies, and business intelligence are major emerging trends and technologies linked to social media analytics. These are trends that BFS entities should be aware of.

How can social media analytics be used to identify and address customer complaints and concerns in real-time?

Social media analytics can be used for identifying customer grievances and complaints on a real-time basis. It can be used to address and respond to these concerns in real-time as well. This can be done through analyzing voluminous data across social media platforms.