In the financial world, good old banks running traditional core systems are facing an uphill task – how to navigate through an ocean of data to understand customer behaviour, and then use those insights to better their offerings.

Welcome Artificial Intelligence (AI), which, unlike humans, can parse tons of data to help traditional financial service providers uncover new product and service opportunities, while also red-flagging anti-money laundering patterns, and identifying fraud. And it’s a trend that is catching on fast.

The use of AI in global banking is estimated to grow from a $41.1 billion business in 2018 to $300 billion by 2030. Per a McKinsey Global AI Survey report, nearly 60 percent of financial services companies have been utilising atleast one AI capability. Currently, AI technologies in vogue include virtual chat assistants for customer service interfaces, machine learning techniques to support risk management and robotic process automation for structuring daily operations.

Incumbent banks primarily have two sets of objectives to fulfil with AI. First, they aim at speed, flexibility and agility, inherent in a fintech. Second, they must adhere to compliances, standards and regulatory requirements of a traditional financial service company.

However, deploying AI to do the heavy lifting isn’t as easy as pushing a button.

In fact, big challenges remain in building responsible and ethical AI systems and simultaneously, traditional financial institutions struggle to deploy in-depth AI capabilities to truly harness its full potential.

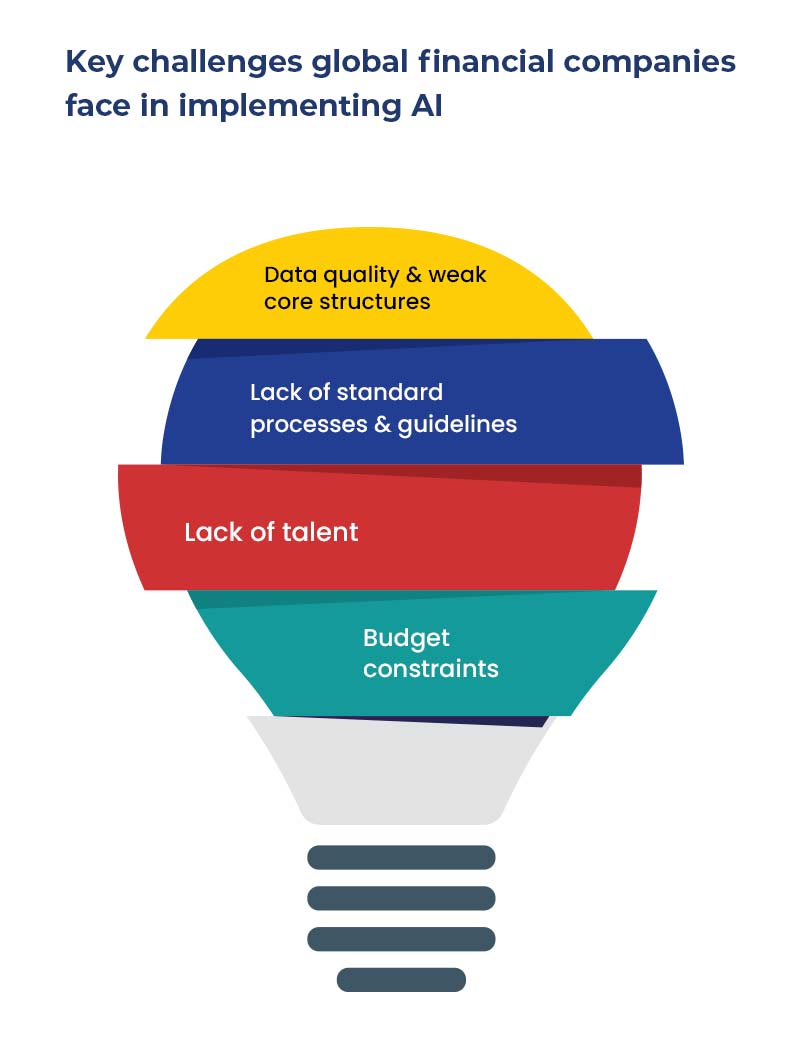

Research finds that the existing data sets in circulation are mostly third-party, unstructured, and a lack of due diligence makes it difficult for AI and ML systems to identify overlapping and conflicting entries. Also, the existing control frameworks lack support for AI-specific scale and volume.

Plus, the algorithm results can even show biased results when written by developers with a biased mind. For instance, A 2020 report stated that Apple cards give upto 20 times less credit to women as the decision AI was fed with an untested, historically biased data set.

Clearly, the financial domain lacks a clear and ethical AI framework to ensure data quality and strengthen the core data structures.

A clear strategy for AI in the financial domain is the need of the hour. Presently, the inflexible, incompetent and weak core structures are bound with fragmented data assets, hampering collaboration between business and technology teams, further resulting in outmoded operating models.

It is pertinent that traditional financial organisations consider the context, use case, and the type of AI model implemented to analyse the appropriate approach while collaborating or upscaling their core tech systems.

AI adoption maybe the talk of the town, but surveys evaluating AI success rates reveal a not-so-happy picture. Per O’Reilly’s 2021 AI Adoption In The Enterprise report, 25 percent of companies saw half their AI projects fail.

Analysis reveals that a key reason for that failure is the lack of capable talent and the ability to reskill in line with a long-term vision. To make things worse, too many firms see talent strategies as an administrative hurdle versus a strategic enabler, resulting in a lack of proper framework around hiring and reskilling in the AI domain.

An omnipresent challenge associated with AI investment is determining the source of money. Will it be an IT project, a change management project or an innovation project? The definitive answer is all three, but only a small fraction of the budget is assigned to AI projects.

But there is some good news on this front. With organisations gaining interest, The Economist’s research team found that 86% of Financial Service’s executives plan to increase AI-related investment over the next five years, with the strongest intent expressed by firms in the APAC (90%) and the North American (89%) regions.

A significant commitment towards AI investment is the need of the hour with a clear focus on bringing in the required human resource capabilities to the front.

Businesses that scale with AI over time, with an unwavering focus on compliance, customer satisfaction, and retention will be the ones laughing all the way to the bank.